Our story

- XTransfer was founded in 2017 when banks were reluctant to provide cross-border payment solution to SMEs due to compliance concerns and system constraint. SMEs had difficulties in getting access to bank services, and paid hefty fees for international money transfer and FX conversion with yet poor service.

- In order to make financial services simple, affordable and accessible to SMEs, XTransfer has built a global multi-currency settlement network along with a data-based, automated, internet-powered, and intelligent risk management infrastructure. XTransfer provides SMEs with the same level of cross-border financial services as large multinational corporations.

Our story

- XTransfer was founded in 2017 when banks were reluctant to provide cross-border payment solution to SMEs due to compliance concerns and system constraint. SMEs had difficulties in getting access to bank services, and paid hefty fees for international money transfer and FX conversion with yet poor service.

- In order to make financial services simple, affordable and accessible to SMEs, XTransfer has built a global multi-currency settlement network along with a data-based, automated, internet-powered, and intelligent risk management infrastructure. XTransfer provides SMEs with the same level of cross-border financial services as large multinational corporations.

Our mission

Making SME financial services simple and accessible

Company milestones

By working with world-renowned banks and financial institutions, XTransfer has set up an integrated global multi-currency settlement platform, as well as a data-based, automated, Internet-powered and intelligent anti-money laundering risk management infrastructure centered on serving SMEs.

XTransfer connects large financial institutions with SMEs at home and abroad through technology so that SMEs may enjoy the same level of cross-border financial services as large multinational groups.

2024

2023

2022

JuneLaunched local receiving account in UK Launched local receiving account in Japan

MarchLaunched local receiving account in Canada

2021

OctoberLaunched SME financing products

SeptemberCompleted Series D fundraising

JulyLaunched CRM product

JanuaryCompleted Series C2 fundraising

2020

OctoberCompleted Series C1 fundraising

2019

OctoberCompleted Series B fundraising

Launched XTransfer App

SeptemberRegistered as an RSP in Australia

2018

OctoberCompleted Series A fundraising

Obtained API license in the UK

AugustRegistered as an MSB in the U.S. and Canada

Launched local receiving account in Europe and the U.S.

DecemberLaunched multi-currency business account

2017

OctoberObtained MSO license in Hong Kong

JulyFounded in Shanghai, China

Our investors

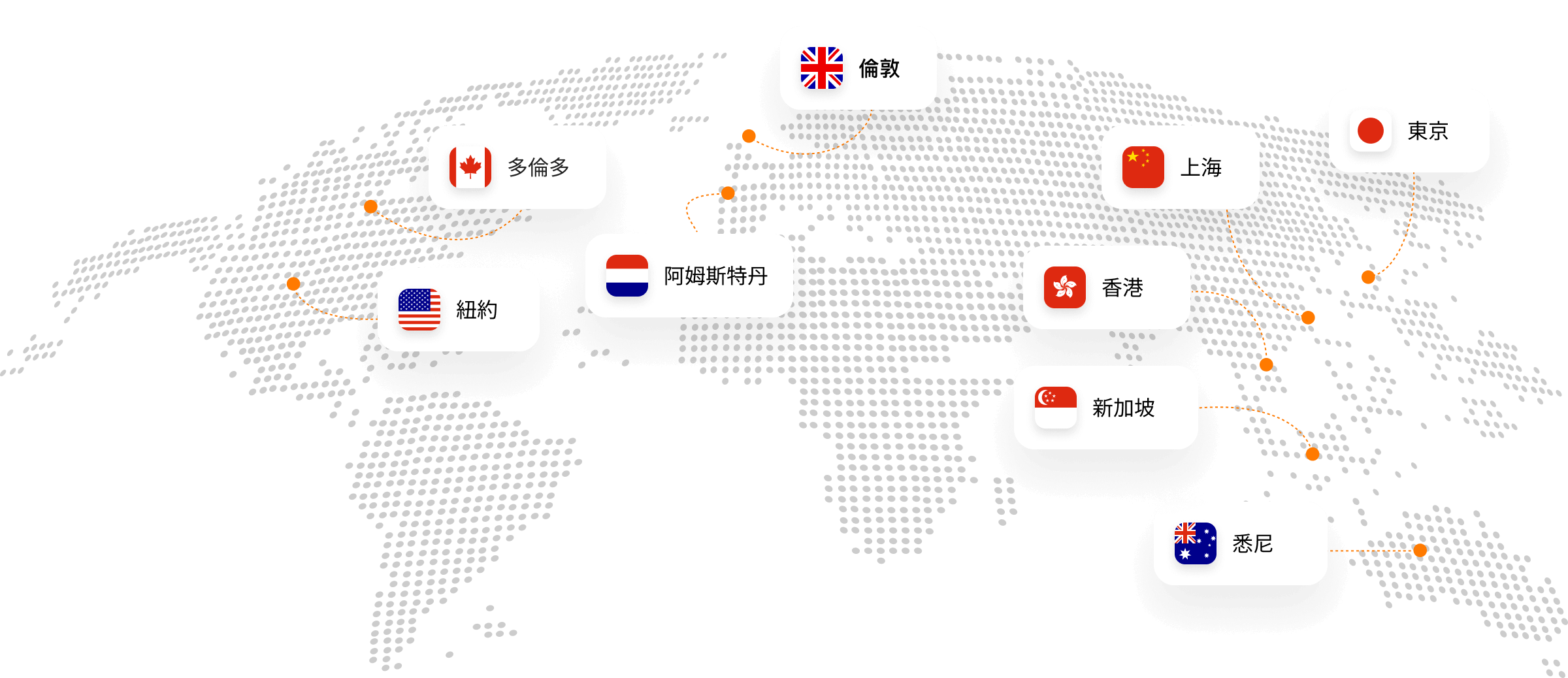

Our global footprint

XTransfer has offices in 8 countries and regions to provide professional local services.