How 3DS Authentication Secures E-Commerce Transactions

Author:XTransfer2025.04.153DS

Online shopping is growing fast, but fraud is a risk. 3DS (3-D Secure) adds a safety step. It makes sure only the real card owner buys things. This helps stop unauthorized purchases.

Think about this: card-not-present (CNP) transactions are rising. These are common in online shopping and grow 9% every year. Experts say they will be more than card-present transactions by 2023. Because of this, keeping online payments safe is very important. Using 3DS helps protect payments and gain customer trust.

Highlights

-

3DS (3-D Secure) adds a safety step for online shopping. It ensures only the real card owner can buy things.

-

Using 3DS lowers fraud and chargebacks a lot. Some businesses see chargebacks drop by up to 99%.

-

3D Secure 2 makes shopping easier. Most payments go through fast without extra steps.

-

Adding 3DS builds trust with customers. This leads to more sales and fewer abandoned carts.

-

Picking the right payment system with 3DS is important. It keeps payments safe and smooth.

Understanding 3DS (3-D Secure)

What Is 3DS and Its Purpose?

3DS (3-D Secure) is a tool to keep online payments safe. It makes sure only the real card owner can buy things. You might see it when asked to prove who you are at checkout. This step could mean typing a one-time code or using your fingerprint.

The goal of 3DS is to stop fraud and fake purchases. By checking your identity, it adds extra safety for you and the seller. This step keeps your payment details safe and builds trust in online shopping.

The Evolution of 3D Secure: From 3DS 1.0 to 3D Secure 2

The first version, 3DS 1.0, used simple ways to check buyers. It worked but sometimes made shopping harder. For example, you might have been sent to another page to verify, which felt annoying.

To fix this, 3D Secure 2 (3DS2) was created. It focuses on better safety and easier shopping. It uses smart tools to check risks quickly, so most payments don’t need extra steps. This is called "frictionless flow" and happens 90-95% of the time. If more checks are needed, 3DS2 uses new ways like fingerprints, making it faster and safer.

Why 3D Secure Is Crucial for E-Commerce Security

Online fraud is growing, especially with card-not-present payments. This makes strong tools like 3D Secure very important. By checking who you are, 3DS stops fake purchases and lowers refund problems for sellers. For instance, sellers in the UK say 3DS solves 94% of issues.

Using 3DS also keeps your money safe and builds trust. When you feel your payment is secure, you’re more likely to shop again. This is even more helpful for sellers at high risk of fraud.

How 3DS Authentication Works

Step-by-Step Process of 3DS Authentication

The 3DS (3-D Secure) system keeps online payments safe by checking who you are. Here’s how it works in simple steps:

-

Pick the items you want and add them to your cart.

-

Enter your credit card details when you check out.

-

Your bank or card company reviews the payment request.

-

If needed, confirm your identity with a code or app.

-

Once verified, the payment is approved, and your order is placed.

This process makes sure only the real card owner can pay. It helps stop fraud and reduces problems like chargebacks.

Roles of Card Issuers, Merchants, and Customers

Each group in 3D Secure has an important job to keep payments safe:

-

Customers: You give your card details and verify when asked.

-

Merchants: They check if your card uses 3DS and share results with the bank.

-

Card Issuers: They confirm your identity using codes or fingerprints and approve payments.

|

Role |

What They Do |

|---|---|

|

Issuer Domain |

Checks cardholder info and handles the verification process. |

|

Acquirer Domain |

Manages the transaction and provides payment systems. |

|

Interoperability Domain |

Helps the merchant and issuer communicate during the process. |

|

ACS (Access Control Server) |

Confirms the cardholder’s identity and 3DS enrollment. |

|

DS (Directory Server) |

Sends messages between the merchant and issuer for 3DS services. |

These roles work together to make online payments safe and smooth.

Key Features of 3D Secure 2: Enhanced Security and User Experience

3D Secure 2 (3DS2) improves safety and makes shopping easier with new features:

-

Behavioral Biometrics: Watches how you type or use your device to spot fraud.

-

Device Information: Collects data about your device to find unusual activity.

-

Risk-Based Authentication (RBA): Lets most payments go through without extra steps.

-

Bot Detection: Tells if a user is real or a bot to stop attacks.

These updates make 3DS2 safer and more user-friendly. It protects payments while keeping checkout fast and easy.

Benefits of 3DS Authentication

Stopping Fraud and Unauthorized Purchases

Fraud is a big problem in online shopping. 3DS (3-D Secure) helps solve this issue. It adds a step to check if the buyer is real. This extra check stops fake purchases and fraud.

For example, ChowNow, a food ordering site, had high chargebacks. These chargebacks were 1% of their revenue. After using tools like 3DS, chargebacks dropped by 99%. This shows how 3DS can stop unauthorized payments.

3DS does more than stop fraud. It also makes payments faster and easier.

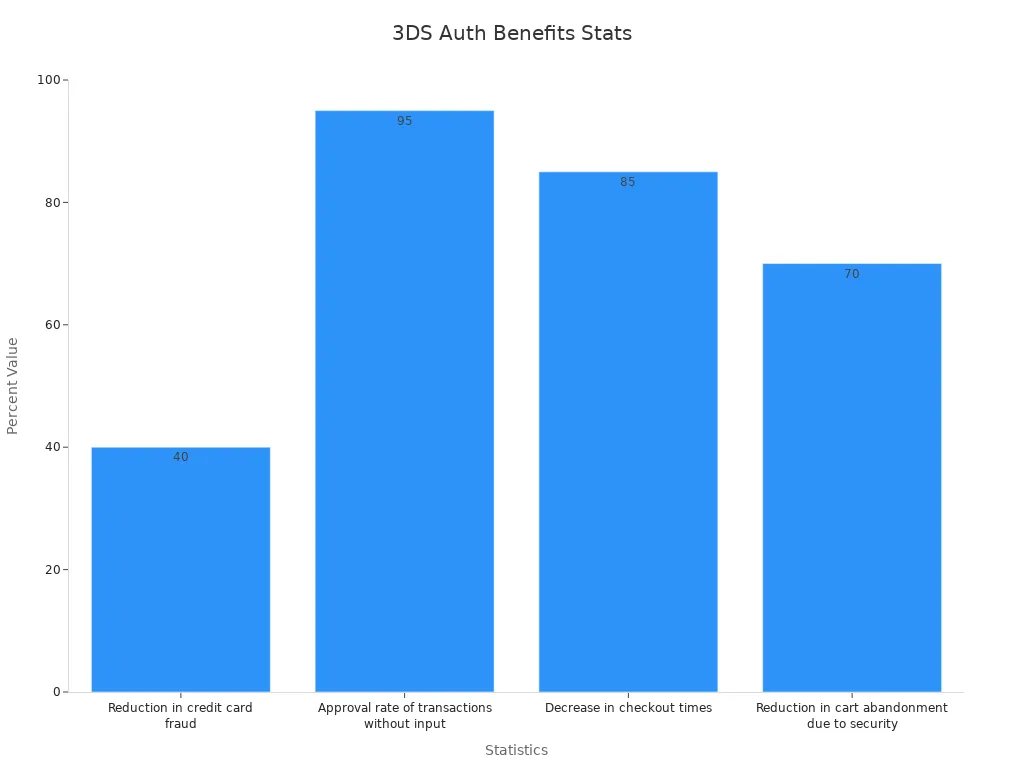

|

Benefit Description |

Percentage |

|---|---|

|

Less credit card fraud |

Up to 40% |

|

Transactions approved without extra steps |

Up to 95% |

|

Faster checkout times |

As much as 85% |

|

Fewer carts abandoned due to security |

Up to 70% |

These numbers show how 3DS keeps payments safe and shopping smooth.

Protecting Sellers with Liability Shift

A great benefit of 3DS is the liability shift. When you use 3DS, fraud responsibility moves to the card issuer. This means sellers don’t lose money from fraud disputes.

For example:

-

Bluefin 3DS moves chargeback costs for fraud to the bank.

-

Using 3DS shifts fraud risks to card issuers, saving sellers money.

This lets sellers focus on growing their business without worrying about fraud losses.

Gaining Customer Trust with Safe Payments

Shoppers care about safety when buying online. Using 3DS shows you protect their payment details. This builds trust and makes them shop again.

When customers see 3DS on your site, they feel secure. This trust lowers cart abandonment and improves your brand’s image.

In today’s online market, strong payment security is key. It shows customers their data is safe, building loyalty and long-term trust.

Addressing Misconceptions and Challenges

Does 3DS Complicate the Checkout Process?

Some people think 3DS (3-D Secure) makes shopping harder. This isn’t fully true. The newer version, 3D Secure 2, improves safety and ease of use. It uses smart tools like risk-based checks. Most payments go through without extra steps. This keeps checkout fast and secure.

A study shows frictionless payments are common now. For example:

|

Region |

Concern Level (%) |

Frictionless Transactions (%) |

|---|---|---|

|

UK |

89 |

>60 |

|

UK/Ireland |

N/A |

81/82 |

These numbers prove most payments are smooth. Even with concerns, 3DS offers both safety and ease.

Overcoming Concerns About Cart Abandonment

Cart abandonment worries many online stores. Some think 3DS might scare buyers away. But the benefits of 3DS are greater than this worry. It cuts chargebacks by up to 70%, saving money for businesses.

Here are some facts about 3DS and cart abandonment:

-

Only 2.7% of online payments use 3DS now.

-

32.4% of businesses have started using 3DS.

-

3DS adds 37 seconds to checkout, causing a 22% drop-off rate.

The extra time may seem bad, but it stops fraud. Teaching buyers about 3DS can also lower drop-off rates.

Implementation Challenges for E-Commerce Businesses

Adding 3DS can be tricky for online stores. Multi-step checks make payments safer but need careful planning. Stores must balance safety with easy shopping.

Here are common problems and fixes:

-

Multi-step Verification: Keeps payments safe but needs smooth setup.

-

Training: Staff must learn about 3DS and online payments.

-

Integration Support: Work with fraud teams to set up and test properly.

-

Ongoing Support: Help staff solve issues and learn more over time.

By solving these problems, stores can use 3DS well. They’ll enjoy less fraud and more customer trust.

Implementing 3DS Effectively

Picking a Payment Gateway with 3D Secure Features

Choosing the right payment gateway is very important. It should support both 3D Secure 1 and 3D Secure 2.0. This ensures it works with the latest safety tools and stops fraud.

Look for gateways with real-time monitoring and strong security checks. These features make payments safer and lower fraud risks. Some gateways send over 100 data points to banks. This helps banks check for fraud better.

Tip: Using a gateway with inline frames that match your site’s design can improve success rates and reduce cart drop-offs.

By picking a gateway with these features, you can keep payments safe and checkout smooth for your customers.

Adding 3DS to Your Online Store

Adding 3DS to your store needs good planning. Work with your payment gateway provider to match it with your business needs. Communication and flexibility are very important. For example, Aylo used teamwork and quick updates to add 3DS successfully.

To avoid problems, make low-risk payments easy. Use tools like 3D Secure Data Only to check risks without extra steps. This keeps payments safe and checkout fast, making customers happy.

A well-planned setup gives you strong security and keeps sales high.

Teaching Customers About 3DS Benefits

Teaching customers about 3DS is very important. Some shoppers stop buying when they see new steps. Clear messages can help fix this. Explain how 3DS keeps their payments safe and stops fraud. Show them how features like fingerprint checks make it quick and secure.

For risky payments, focus on the extra safety 3DS gives. For safer payments, assure them the process will stay fast and simple.

Note: Studies show 77% of shoppers quit purchases due to confusion. Teaching them about 3DS builds trust and helps them finish their orders.

When customers see the value of 3DS, they’ll use it more. This lowers fraud and builds loyalty to your store.

3DS helps keep online payments safe and stops fraud. Using it protects your business and earns customer trust. The 3DS market is growing fast, from $723.61 million in 2022 to $2,566.99 million by 2033. This shows how important it is becoming. As online fraud increases with more e-commerce, 3DS offers strong security. By using 3DS, you can protect your business and make customers feel safe shopping online.

FAQ

What is 3D Secure 2, and how does it make payments safer?

3D Secure 2 keeps payments safe by checking who you are. It uses smart tools like how you type or move your mouse. These tools stop fraud and make checkout easier for you.

Can 3D Secure 2 help stop chargebacks?

Yes, it can. 3D Secure 2 checks your identity to stop fake payments. This helps stores avoid problems and saves them money from chargebacks.

How does 3D Secure 2 protect merchants from fraud costs?

When you use 3D Secure 2, fraud costs move to the bank. This means stores don’t lose money from fake purchases. They can focus on growing their business instead.

Will 3D Secure 2 make checkout slower?

Usually, no. 3D Secure 2 uses smart checks to skip extra steps. Most payments are fast and safe without slowing you down.

Why is 3D Secure 2 important for online shopping safety?

Online fraud is a big problem. 3D Secure 2 adds a safety step by checking who you are. This makes shopping safer for you and the store.

Related content